The 25-Second Trick For Best Investment Books

Wiki Article

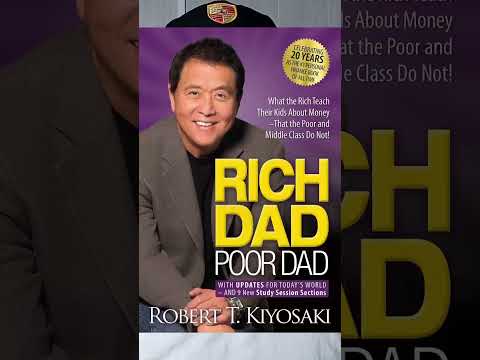

The most beneficial Expenditure Guides to Study For Beginners

Investing might be overwhelming, but Mastering the terms, jargon, methods and implementations that go together with it could make the knowledge less difficult. Benjamin Graham (the "father of value investing") wrote this e-book in 1949 that is certainly an indispensable read through for all those wanting to preserve and spend their income properly.

This 2019 guide is right for newbies as it distills complicated investment matters into simply understandable chapters.

The Psychology of cash

The ideal investment decision books explore funds administration and investing, how to make sensible options with price savings and investments, and why all Grown ups (such as Young ones, teens and younger Grown ups) should really possess at the very least a essential knowledge of investing. These publications present an outstanding approach to find out about a subject which has an effect on all our lives - whether it is attorneys, business owners, investment decision bankers, Medical practitioners or digital Entrepreneurs; being very good with dollars will profit you all through your occupation journey.

A Biased View of Best Investment Books

Graham and Buffett's timeless typical The Intelligent Investor stays an indispensable guidebook for commencing investors. This basic introduces value investing - which is composed of purchasing companies with sturdy financials and lengthy-phrase prospects at discounted prices - by means of discount pricing on inventory marketplaces. Moreover, The Intelligent Investor explores diversification, lengthy-expression investing horizons, greenback Charge averaging together with other principles important for thriving investing.

Graham and Buffett's timeless typical The Intelligent Investor stays an indispensable guidebook for commencing investors. This basic introduces value investing - which is composed of purchasing companies with sturdy financials and lengthy-phrase prospects at discounted prices - by means of discount pricing on inventory marketplaces. Moreover, The Intelligent Investor explores diversification, lengthy-expression investing horizons, greenback Charge averaging together with other principles important for thriving investing.Philip Fisher's Popular Perception Investing has very long been thought of one of the typical investment books. Initial published in 1958, this work provides audience with tactics for selecting shares with probable for prime returns making use of techniques just like the Scuttlebutt strategy (listening in on what rivals say regarding your focus on firm before making your order) or Exclusive conditions (invest in businesses which spend dividends on an ongoing foundation).

This limited still thorough guide by Aswath Damodaran from NYU Stern Faculty of Organization will teach you the way to benefit a business and choose stocks. By understanding its rules of discounted income flows calculation, modeling shareholder value development, accounting statements and ratio analysis.

Lots of investing publications focus on what to do; The 5 Problems Every Investor Will make is created to assist readers prevent creating high-priced errors when generating monetary choices. It handles a few of the most Regular glitches produced by investors such as succumbing to concern and greed and overconfidence - having day out for reading this financial commitment guide may perhaps help save you from some costly missteps!

The Simple Route to Wealth

Facts About Best Investment Books Uncovered

This e book details how any specific can crank out prosperity via very simple yet time-tested methods that demand nominal Strength or energy. It demonstrates how To guage an asset's intrinsic worth, diversify their portfolios, and control chance - ideas which have confirmed them selves over time among modern primary traders. It is easy to examine, but its timeless ideas have had Long lasting impacts between present-day leading buyers.

This e book details how any specific can crank out prosperity via very simple yet time-tested methods that demand nominal Strength or energy. It demonstrates how To guage an asset's intrinsic worth, diversify their portfolios, and control chance - ideas which have confirmed them selves over time among modern primary traders. It is easy to examine, but its timeless ideas have had Long lasting impacts between present-day leading buyers.This classic financial commitment e book has grown to be among the best-offering titles ever released, and once and for all rationale: it provides Probably the most detailed guides to investing currently available. This timeless text teaches viewers how to analyze corporations, stay away from mistakes, and make clever investments based on their unique conditions and plans. Furthermore, it explores subject areas not protected somewhere else like housing investments, venture funds funding and hedge fund administration management.

Rookies aiming to spend should look at this e book; it offers a step-by-phase strategy that is simple and user-pleasant. Kindle Model prices less than a person dollar, and makes use of true-everyday living illustrations from its author to show how money can develop with minimum hard work.

Ben Graham supplies Perception into his investing philosophy praised by a source lot of the environment's most famous investors in this traditional guide by Ben Graham. His emphasis is on discovering reduced-danger, superior-return investments with extensive-time period opportunity - nevertheless shares can typically fluctuate wildly involving staying low cost one day and costly the following!

The Ultimate Guide To Best Investment Books

As our oldest investment traditional, check here this timeless study must be on Anyone's reading list. It addresses fundamentals including stock investigate and variety along with passive investing via index resources - tips which has been proposed by distinguished figures like Bill Ackman, John Griffin, Dan Loeb and Mohnish Pabrai them selves!

As our oldest investment traditional, check here this timeless study must be on Anyone's reading list. It addresses fundamentals including stock investigate and variety along with passive investing via index resources - tips which has been proposed by distinguished figures like Bill Ackman, John Griffin, Dan Loeb and Mohnish Pabrai them selves!The Outsiders

In this particular e-book, the creator demonstrates here normal people today how they will make investments like gurus with just a little aid. It truly is an ideal financial investment e-book for novices as it provides many valuable information in a straightforward-to-read format. He handles fundamentals like handling fear and greed along with training readers how to select shares with very simple guidelines - supporting buyers Develop portfolios with substantial returns.

This common investment e-book has been around for many years and continues to be an indispensable resource for investors of all ages. The authors investigate historical evidence, economics and market place principle to stipulate vital aspects of effective investing; which includes diversification and lower-Value investing together with how to stay away from common errors while cultivating disciplined investing methods.

As new investments might go Improper, It really is necessary to find out from your encounters of master investors. Many amateur traders repeat equivalent mistakes over and over, but reading investment guides may also help prevent these pitfalls. The writer of this book provides a functional information for investing depending on successful fund supervisor tactics; educating readers how to choose successful stocks by outlining good quality management rules focused on high-quality and price.

Traditional guides such as this 1949 publication from Ben Graham remain timeless classics and will be crucial reading for any person wanting to be aware of the fundamentals of investing. It focuses on organization valuation and the way to location undervalued organizations that should return important returns for buyers, although highlighting margin of protection factors and benefits of paying for worth shares over progress shares.

This guide blends own finance with background to show how the earth's leading traders have designed their fortunes as time passes. The writer highlights how prosperous investors have been in a position to beat their fears and resist greed's temptations though discussing its effect on economic marketplaces. Also, this text discusses social and political events' influence above money marketplaces.

The Minimal Guide of Frequent Feeling Investing

4. The Minor Ebook of Prevalent Perception Investing

New buyers normally make the error of thinking they demand a significant sum to start investing, when in reality any amount is enough. This traditional guide offers assistance for creating and developing an asset portfolio with minimum money even though diversifying threat management and making smart investing conclusions are talked over in the course of its web pages.